Florida, May 31 – In the municipality of Florida the great majority of private economic actors disobey their legal obligation to deposit part of their monetary income in banking entities.

A direct consequence of this non-compliance is the current low availability of cash in financial institutions, which causes delays in the payment of salaries to some labor groups, in addition to limiting the vitality and scope of services and financial operations essential for local economic activity.

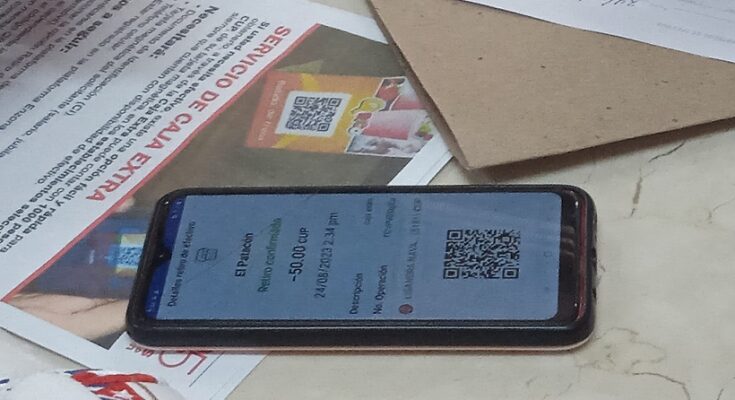

Most of these private economic actors also do not offer their customers the possibility of paying for their products and services through electronic payment channels or digital platforms, and this means that the high dependence on paper money to meet basic daily needs remains almost intact.

This situation causes the growth of queues in search of cash at the only two ATMs in the municipality, which are increasingly difficult to supply, according to the management of the branch of Banco de Crédito y Comercio in Florida.

In view of this panorama, governmental action is urgently needed in this territory, for which the state must increase its demands and control over the fulfillment of the legal obligations so that all the economic actors materialize the established bank deposits and enable electronic payment channels for the commercialization of their products and services.

In a recent working visit to the territory of the Central Committee of the Communist Party of Cuba, it was pointed out that the Municipal Banking Group is not working effectively, since the number of digital payment channels has not increased and those who fail to comply with this obligation have not been sanctioned, to the detriment of the welfare of the population and the local financial activity.